In today's fast-paced business world, efficient payment collection and reconciliation are crucial. Bulkpe's Virtual Account Stack makes this easy by automating payment collection, using virtual accounts to streamline financial operations with exceptional efficiency and accuracy.

Understanding Virtual Accounts

Virtual accounts are specialized bank accounts linked to an underlying account, acting as ledgers that keep funds in a virtual wallet. All payments are gathered into the main bank account, which could be a current, escrow, or nodal account. This setup lets businesses track, reconcile, collect, and pay effectively, even on a large scale.

- Learn More About Virutal Accounts: Bulkpe Collection Stack

- Explore Virtual Account API Documentation Docs.Bulkpe.In

The Benefits of Bulkpe's Virtual Account Stack

Bulkpe's Virtual Account Stack allows businesses to automate payment collection via API integration or the Bulkpe dashboard. This automation simplifies financial management and ensures real-time reconciliation, reducing manual errors and administrative tasks.

- Automated Payment Collection: For each customer or invoice, create a virtual account through Bulkpe's API or dashboard. Share this account with customers via the invoice for easy payment collection.

- Real-Time Reconciliation: Payments are captured and reconciled immediately, eliminating the need for manual reconciliation and saving time.

- Scalability: Whether you handle a few transactions or thousands, Bulkpe's system scales with your business, ensuring smooth and efficient payment processing at any volume.

- Enhanced Tracking and Reporting: Each virtual account provides detailed payment tracking, helping businesses monitor and report financial activities accurately. This improves transparency and aids better financial planning and analysis.

Real-Life Example: Simplifying Business Operations

Imagine a subscription-based business collecting monthly payments from hundreds of customers. Traditionally, this involves sending invoices, waiting for payments, and manually reconciling each transaction. With Bulkpe's Virtual Account Stack, the process is much simpler:

- Invoice Creation: Generate an invoice for each customer and create a corresponding virtual account using the Bulkpe dashboard or API.

- Payment Collection: Include the virtual account details in the invoice sent to the customer. The customer makes the payment using these details.

- Real-Time Reconciliation: Payments are captured and reconciled instantly by Bulkpe's system, updating your financial records immediately.

- Efficient Management: Track all payments through the virtual accounts, ensuring all transactions are accounted for and reconciled without manual effort.

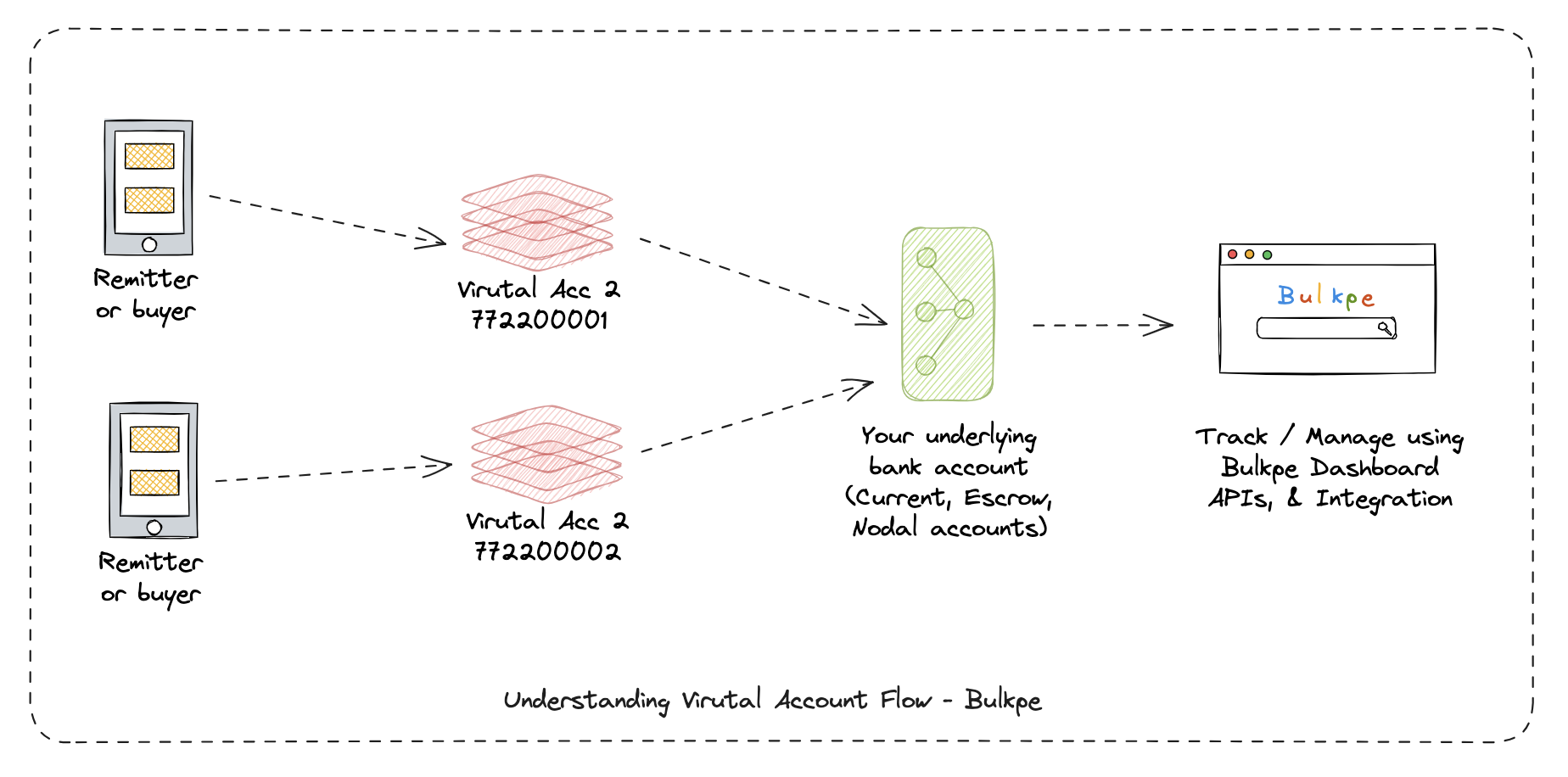

Virtual Account Flow

This flow daigram helps understanding the money flow

Better Tracking of Receivables

One of the significant advantages of virtual accounts is the centralization of business operations. Businesses can create numerous virtual accounts linked to a single physical account, offering a unified view of cash flow and liquidity management. This system eliminates the need to check multiple accounts, streamlining the tracking of receivables.

Reduced Dependency on Banks and PSPs

New-age payment solutions simplify virtual account management. Unlike physical accounts, virtual accounts can be created in real-time without relying on third parties or banks. This reduces the turnaround time (TAT) for account creation and allows businesses to deactivate customer accounts as needed. Any pending or ongoing transfers to a disabled virtual account are automatically rejected, minimizing manual errors and eliminating redundant accounts.

Easily Deployable with Developer-Friendly Integration

Modern payment platforms provide detailed integration guides. For example, Cashfree Payments offers simple APIs for accepting payments through virtual accounts, allowing businesses to create as many virtual accounts as needed without external dependency. This scalability ensures that virtual accounts grow with your customer base.

Outdated Virtual Account Management Systems: A Business Challenge

Traditional banks often have outdated virtual account management systems unsuitable for tech-first companies. Fast-growing SMEs and corporates benefit more from modern PSPs that scale with their business. Here are some challenges posed by traditional systems and solutions offered by new-age virtual account systems:

- Limiting Virtual Accounts to Bank Accounts: New systems offer virtual UPI IDs.

- Limited Payment Modes for Collection: Modern systems provide all popular payment modes, including UPI, IMPS, NEFT, RTGS, and more.

- Restricted by Banking Hours: Modern systems operate in real-time, allowing instant settlements.

- Inefficient Reconciliation: Real-time reconciliation through APIs eliminates errors and delays.

- Outdated Technologies: Tech-first solutions support fully numeric virtual accounts and scale with technological advancements.

Who Can Benefit from Virtual Accounts?

Given the rapid digitization of payment collection, virtual accounts are versatile and beneficial for many online businesses, including:

- B2B Platforms and Marketplaces: Easy reconciliation for payments from numerous retailers.

- Franchise Outlets: Streamlined payment collection by assigning virtual IDs to each outlet.

- Educational Institutions and Utility Companies: Unique virtual accounts for students or users to facilitate timely payments.

- Lending and Insurance Companies: Efficient premium and repayment collection through virtual accounts.

Let's simplify payment collections

Bulkpe's Virtual Account Stack is a breakthrough for businesses aiming to automate payment collection and reconciliation. By using virtual accounts, businesses can achieve higher accuracy, efficiency, and scalability in their financial operations. Whether you're a small business or a large enterprise, Bulkpe's Virtual Account Stack can meet your needs, simplifying payment processes so you can focus on growing your business.

If you think this can help your business

- Sign in Bulkpe: App.Bulkpe.in

- Please feel free to email us to schedule a call [email protected]